🔵 **Veritaseum Technical Whitepaper Series — Part 1

Smart Metal: The Foundational Engine for RWA & CBDC (2025 Deep-Dive Edition)**

📌 *“Smart Metal is the origin layer of the entire Veritaseum patent ecosystem —

the first real-world value engine designed for the CBDC/RWA era.”*

1. Why Smart Metal Was Created (The Core Problem)

The traditional financial system has never solved the structural problem of

bringing real-world assets (RWA) like gold into a digital environment safely.

Key limitations:

- Physical metals are slow, non-portable, and settlement is not instant

- Cryptocurrencies are volatile and unsuitable for value storage

- Banks, brokers, and exchanges introduce counterparty risk

- CBDCs have no built-in mechanism to connect with physical assets

- There is no global standard for real-world value transfer without intermediaries

Smart Metal was designed to overcome these limitations.

🔹 Definition

“A digital engine that mirrors the intrinsic value of physical metals

while eliminating intermediaries and integrating with national settlement systems.”

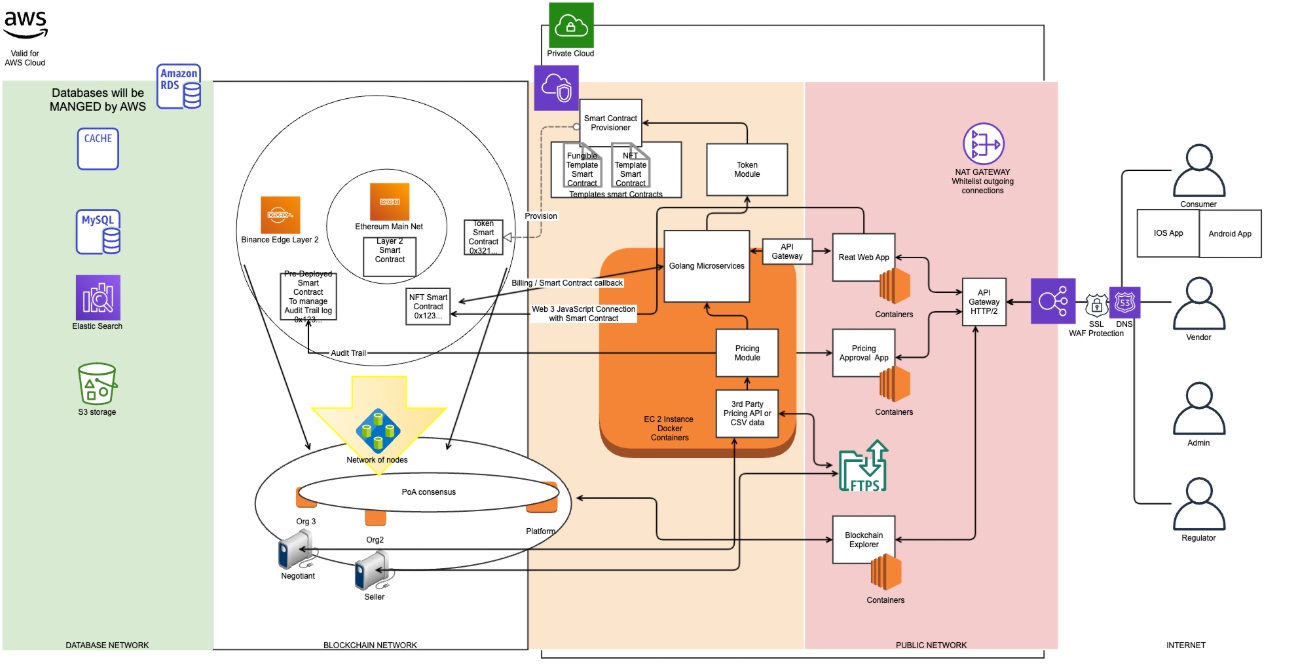

2. How Smart Metal Works (Core Architecture)

Smart Metal is not a simple “gold token.”

It is a patent-backed automated value alignment engine.

✔ 1) 1:1 Value Reference to Real Metals

Smart Metal is designed to track:

- Gold

- Silver

- Copper

- Strategic metals

Their market price movements are reflected in the Smart Metal unit automatically.

✔ 2) Automated Value Rebalancing

A key mechanism from the Veritaseum patents:

- If gold price rises → Smart Metal value adjusts upward

- If gold falls → Smart Metal adjusts downward

- No human intervention

- No central server

- Rules are enforced through a Non-Turing financial machine

✔ 3) Zero Counterparty Risk

Traditional systems rely on:

- Banks

- Clearing houses

- Exchanges

- Custodians

Smart Metal removes these entirely:

Direct settlement → instant → no intermediary risk.

3. How Smart Metal Differs from Gold ETFs or Tokenized Gold

CategoryGold ETF / Tokenized GoldSmart Metal

|

Backing

|

Institution-dependent

|

Structural 1:1 value reference

|

|

Risk

|

Custodian / exchange risk

|

Counterparty risk eliminated

|

|

Settlement

|

Hours to days

|

Instant

|

|

Regulation

|

Nation-specific

|

Designed for CBDC & ISO20022

|

|

Patent protection

|

None

|

US & Japan patents granted

|

Smart Metal isn’t a “better gold token.”

It is the regulatory-compatible value-engine for CBDCs and RWAs.

4. Why Smart Metal Becomes Critical in the CBDC Era

CBDCs alone cannot serve as a store of value —

they are essentially “digital cash.”

Smart Metal fills the structural gap.

✔ 1) The bridge between CBDC ↔ Real-World Assets

From 2026 to 2030, global regulators push mandatory RWA integration.

Smart Metal offers:

- Transparency

- Intermediary-free settlement

- Stable real-asset grounding

✔ 2) CBDC stability enhancement

A CBDC connected to Smart Metal gains a

real-world intrinsic value layer — something fiat lacks.

✔ 3) Works with national strategic metal policies

- China → gold reserves expansion

- Japan → JPYC RWA experimentation

Korea → Digital Won + RWA regulatory framework

Smart Metal aligns with all three.

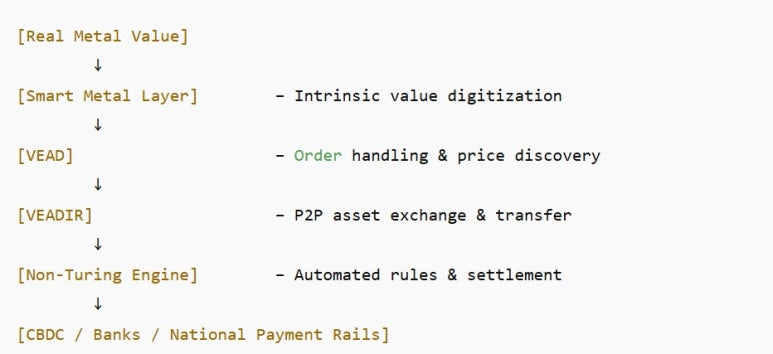

5. How Smart Metal Fits into the Veritaseum Patent Stack

It is the first layer in the Veritaseum modular architecture.

[Real Metal Value] ↓ [Smart Metal Layer] – Intrinsic value digitization ↓ [VEAD] – Order handling & price discovery ↓ [VEADIR] – P2P asset exchange & transfer ↓ [Non-Turing Engine] – Automated rules & settlement ↓ [CBDC / Banks / National Payment Rails]

Smart Metal connects:

Physical → Digital → National settlement infrastructure

6. Why Smart Metal Is Especially Crucial for Korea / Japan / China

🔹 Korea

- Digital Won rollout

- RWA regulatory restructuring

- Demand for “stable RWA structures” → perfect alignment with Smart Metal

🔹 Japan

- JPYC pilots with real-world asset link

FSA prioritizes “high-trust” asset-backed structures

🔹 China

- Gold accumulation strategy

- e-CNY + cross-border real-asset networks

- Patent approval projected for 2026 Q1

Smart Metal is the common denominator for East Asia’s CBDC/RWA evolution.

7. Conclusion

Smart Metal is the first engine of the Veritaseum ecosystem.

It provides:

- Real-world value storage

- Instant settlement without middlemen

- Patent-secured architecture

- CBDC compatibility

- RWA structural integration

- National-scale financial stability enhancement

Smart Metal is not a “product.”

It is the foundational module for CBDC/RWA systems from 2026–2030.

📘 Disclaimer (Educational Purpose Only)

This document is for educational and analytical purposes

regarding international financial standards (ISO20022), CBDC, and RWA infrastructure.

It does not represent the official position of Veritaseum Inc.

All interpretations are non-commercial and based on publicly available information.

📡 Source & Attribution Notice

This content does not represent the official views of Veritaseum Inc.

Reposting is permitted only when the source (Veritaseum Korea / Dadam Elecronics Co.,ltd. ) is clearly cited.

Unauthorized reproduction or redistribution is prohibited.

'VERITASEUM HISTORY' 카테고리의 다른 글

| 📘 Veritaseum Technical Whitepaper Series — Part 2 (0) | 2025.12.05 |

|---|---|

| 🔵 Veritaseum 기술 백서 1편 — Smart Metal 완전 해부 (2025 심화 버전) (0) | 2025.11.28 |

| 📊 Veritaseum이 글로벌 금융 구조에 미치는 잠재적 영향 — 발표용 8장 핵심 슬라이드 (2) | 2025.11.15 |

| 4. 베리타세움(Veritaseum)이 글로벌 금융 구조에 미치는 잠재적 영향 — 요약 분석 (0) | 2025.11.15 |

| 3. Veritaseum 경쟁 기술 비교 분석 (Competitive Landscape Analysis) — 기존 금융/블록체인 인프라가 대체할 수 없는 ‘특허 기반 P2P 구조’의 차별성 (0) | 2025.11.15 |